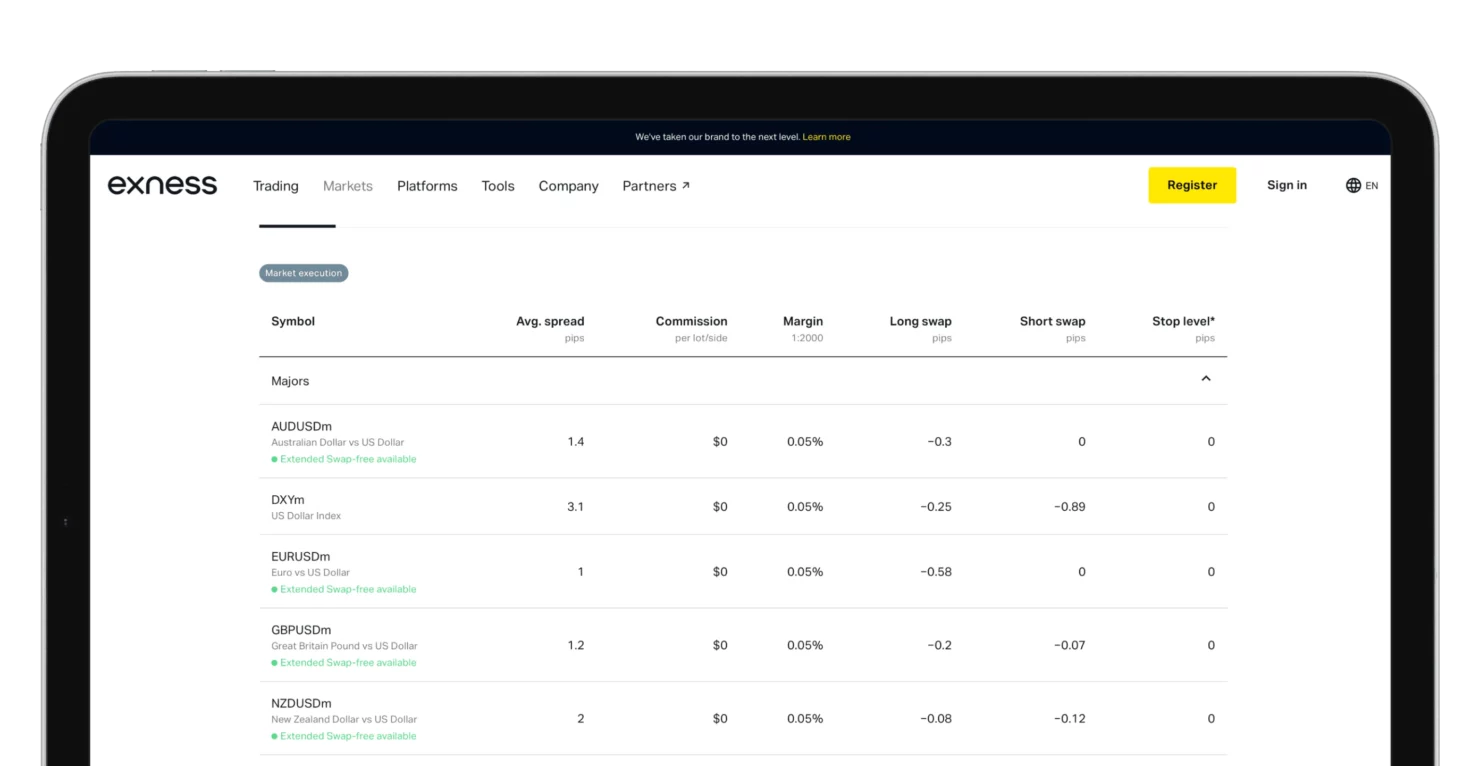

Exness Spread

Exness offers competitive spreads for the forex traders. A spread is the difference between what buyers are willing to pay-a bid price-and what sellers are asking-an ask price. Spreads may reduce the trading cost, and understanding this relationship may maximize profitability from trades. According to Exness, they offer both floating and fixed spreads, depending on the type of account one happens to be operating. This allows traders flexibility in their choice based on their trading style.

What is Spread in Forex Trading?

In forex trading, the spread is the price for each trade. Assuming the bid price for EUR/USD is 1.1000 and its ask price is 1.1002, then the spread would amount to 2 pips. This is basically the brokerage fee in accomplishing your trade. Lower spreads equate to lower costs of trading, which is beneficial for scalpers and high-frequency traders. On Exness, spreads depend on the type of account and market conditions.

Spreads can be determined by several factors, including market volatility, liquidity, and the particular instrument that is being traded. During high market activity, like major news events, the spreads could go wider. Exness provides complete transparency by displaying real-time spreads right within its platform for better trader decision-making. Understanding spreads, and more importantly, how they can affect trading, is key to cost management.

Types of Spreads Available on Exness

Exness offers two main types of spreads: floating and fixed. While floating spreads alter due to market conditions such as liquidity and volatility, fixed spreads are unaltered, thus offering predictability for some trading strategies. In such a way, traders can select spreads according to their goals of trading, whether they need flexibility or consistency in trading costs.

Floating Spreads on Exness

Floating spreads are dependent on market activity. They tend to narrow during high liquidity, such as at the overlap of major markets, which could result in lower trading cost for the traders; during high volatility or low liquidity, the spread may widen. Exness makes its spread in real-time available on its platform for better planning by traders. In essence, floating spreads are suitable for traders whose strategies are premised on dynamic pricing.

Fixed Spread on Exness

Fixed spreads do not change with market conditions and allow one to maintain stable trading costs. This is especially important for those traders who depend on strategies such as scalping or grid trading, where their profitability depends on consistency in cost. With fixed spreads, traders can strategize a trade with much more certainty, knowing they won’t be caught off guard by price jumps. Through Exness, pricing is very transparent, enabling traders to exploit fixed spreads for superior planning and management of costs.

How Exness Spreads Affect Trading Profitability

Exness spreads directly affect trading costs and, consequently, profitability. Lower spreads result in a reduced cost per trade, enabling traders to retain more of their profits. On the other hand, wider spreads lead to increased costs, especially for frequent traders like scalpers. The trader’s comprehension of the spreads for various Exness account types and their trading conditions greatly assists in making informed choices to maximize returns.

Impact on Trade Execution

The size of the spread can also affect trade execution in the following ways:

- Entry Costs

Higher spreads mean you start with a larger unrealized loss.

- Scalping Strategies

Wide spreads can reduce the effectiveness of small, frequent trades.

- Stop-Loss Placement

Wide spreads may trigger stop-losses earlier than expected.

For example, during high volatility, floating spreads can widen, impacting the actual cost of execution. Traders should monitor spreads and adjust strategies like position sizing and risk management to minimize these impacts.

Calculating Trading Costs Based on Spreads

Trading costs can be calculated using the formula:

Spread (in pips) × Lot Size × Pip Value = Total Cost.

| Spread Type | Spread Value | Lot Size | Pip Value | Cost |

| Floating Spread | 1.5 pips | 1 lot | $10 | $15 |

| Fixed Spread | 2.0 pips | 1 lot | $10 | $20 |

For instance, if you trade 1 lot of EUR/USD with a floating spread of 1.5 pips, the cost will be $15. By comparing spreads, traders can choose the most cost-efficient accounts and adjust strategies for profitability.

Calculating these costs in advance helps traders make better decisions, whether they are trading high-volume or long-term positions.

Trading Strategies Based on Exness Spread

Exness spreads are a core determinant in developing trading strategies. Low spreads will best fit when scalping and performing day trading, since not big price movements are targeted. For longer-term strategies, traders must account for potential spread changes during low liquidity or volatile periods. Understanding the way spreads vary across different account types and market conditions helps traders plan effectively.

Scalping and Low Spreads

The essence of the scalping strategy is to open lots of trades in very short periods, watching the price move by points. Low spreads are crucial in these cases since higher spreads rapidly devour profits. Floating spreads are commonly preferred during high-liquidity sessions, like overlaps of big markets, to lower costs and increase efficiency.

Long-Term Trading and Spread Considerations

For longer-term trading, the impact of the spreads is different. With trades being held for several days or even weeks, the spread cost becomes a smaller fraction of the overall strategy. Nevertheless, traders should give some thought to possible widening of spreads during periods of low liquidity-for example, after-hours or during economic announcements. Wider spreads can impact profitability, mainly during trade entry and exit.

Fixed spreads can provide stability in long-term strategies because one’s costs remain predictable, regardless of market conditions. For example, Exness Zero accounts provide consistent spreads that make cost management easier to plan for in extended strategies. This approach ensures that long-term trades align with financial goals without unexpected costs.

Factors That Influence Spreads on Exness

Spreads on Exness depend on a few factors: market conditions, account type, and trading instruments. When market activity is high, the spread usually widens due to higher volatility. Furthermore, the account type you decide to open will also be a factor in the spread; for example, whether you open a Standard or Raw Spread account. The instruments are major forex pairs that typically have tighter spreads compared to more exotic pairs or commodities.

Market Volatility and Spreads

Market volatility has a significant impact on spreads. Key factors include:

- High Volatility Events: News releases and economic data can cause spreads to widen.

- Market Sessions: Spreads are often narrower during active trading sessions, such as the London-New York overlap.

- Low Liquidity Periods: After-hours or holiday trading can lead to wider spreads.

For instance, during major announcements like interest rate decisions, spreads can increase significantly. Traders should monitor the economic calendar and adjust their strategies accordingly to avoid unexpected costs.

Account Type and Spreads

The type of account you use also influences spreads. Exness offers options with varying spread structures:

- Standard Accounts: Feature floating spreads, suitable for general trading.

- Raw Spread Accounts: Offer near-zero spreads with a commission fee.

- Zero Accounts: Provide fixed spreads on select instruments, ensuring cost predictability.

For example, a trader using a Raw Spread account may pay lower spreads during high-liquidity periods but needs to factor in commission charges. Choosing the right account type depends on your trading style and strategy. Balancing spread costs with other fees ensures better profitability.

Comparing Exness Spreads with Other Brokers

In comparing Exness spreads with those of other brokers, many traders find it rather competitive. Exness offers low and transparent spreads across account types. That makes it appealing to both beginners and professionals. While most brokers put forward attractive spreads during high-liquidity periods, Exness is consistent with its offerings, such as Raw Spread and Zero accounts, for the cost-effectiveness of the traders.

How Exness Spreads Stand Out

Spreads vary at Exness, catering to different trading styles: exceedingly low spreads for scalpers and day traders, especially in the most liquid market sessions. This will help to minimize transaction costs and ensure a better profit from short-term trades. Moreover, the ability to choose either floating or fixed spread will further tune it up according to the market conditions.

Another distinguishing feature of Exness is that it offers near-zero spreads on Raw Spread accounts and fixed spreads on Zero accounts for selected instruments. The result of this much transparency in dealings is that traders know their costs up-front, and therefore, they can plan and execute their trades more effectively, especially during volatile periods.

Spreads on Major vs. Exotic Pairs

Exness provides tighter spreads on major currency pairs compared to exotic pairs due to higher liquidity in major markets. Here’s a comparison:

| Currency Pair | Averages Spread |

| EUR/USD | 0.1 pips |

| GBP/USD | 0.2 pips |

| USD/TRY | 2.5 pips |

| EUR/SEK | 3.0 pips |

Exotic pairs typically have wider spreads due to lower liquidity and higher risks. Traders focusing on majors benefit from lower trading costs, while those trading exotics must account for the added spread when planning strategies.the Exness Islamic account lets you trade a wide range of assets at minimal cost, all while respecting your values.

FAQs About Exness Spreads

What are the average spreads on Exness?

Exness offers competitive spreads depending on the account type. For major pairs like EUR/USD, spreads can go as low as 0.1 pips on Raw Spread accounts. Floating spreads are available for Standard accounts, offering flexibility based on market conditions.

Are Exness spreads suitable for beginners?

Yes, Exness spreads are beginner-friendly, especially on Standard accounts with floating spreads. These accounts offer a balance between cost and simplicity, ideal for new traders.

How can I reduce the cost of spreads?

Yes, Exness offers Zero accounts with no spreads on specific instruments. These accounts are perfect for traders seeking predictable trading costs.

What are the spreads on exotic currency pairs with Exness?

Exotic currency pairs on Exness typically have wider spreads compared to major pairs due to lower liquidity. For example, pairs like USD/TRY or EUR/SEK may have spreads ranging from 2.5 to 3.0 pips on Raw Spread accounts. Spreads can vary depending on market conditions and account type.

Which Exness account has the lowest spreads?

The Raw Spread account offers the lowest spreads on Exness, starting from 0.0 pips. This account is ideal for traders looking for precise cost management and lower transaction fees.