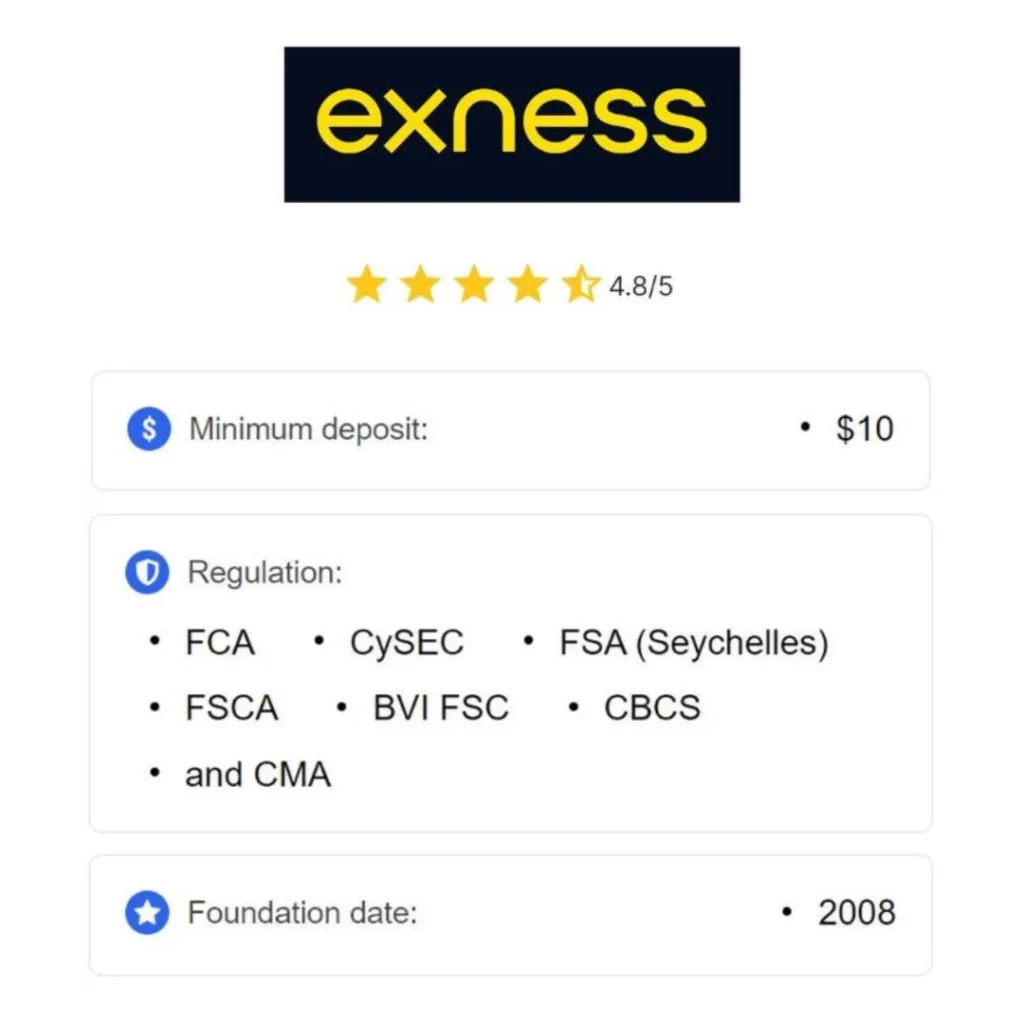

Exness Regulation

Exness is a well-regarded and licensed brokerage firm that functions strictly under the conditions of fair, open, and lucid trading. According to several accredited financial bodies, the site is supervised with great deliberation over conformation with international standards. Regulation guarantees the security of clients’ funds and monitoring of trading activities for transparency. Such control allows traders to feel more confident in their investments when using services related to Exness.

Regulatory Authorities Overseeing Exness

This brokerage company operates under the supervision of widely recognized financial regulators. Such organizations guarantee that a broker follows the tightest guidelines to enable traders to work in complete safety. According to one of the requirements set by these regulators, Exness has to keep client funds in separate accounts.

As for the commitment of Exness to compliance, this means international standards translate into regular audits, operational transparency, and adherence to best practices. Traders appreciate knowing their broker is held accountable by respected authorities; such a feeling provides layers of trust and security in places.

Major Regulators

Exness is licensed and regulated by the following authorities:

- Cyprus Securities and Exchange Commission (CySEC): Ensures compliance with European Union financial laws.

- Financial Conduct Authority (FCA): Regulates activities in the UK to protect traders.

- Financial Sector Conduct Authority (FSCA): Oversees Exness in South Africa.

- Seychelles Financial Services Authority (FSA): Provides regulation for international operations.

These licenses demonstrate Exness’s commitment to operating under high standards, making it a reliable choice for traders globally.

Regulation offers significant benefits for traders, including:

- Fund Protection: Client funds are stored in segregated accounts.

- Transparency: Clear and honest trading practices are maintained.

- Fair Trading Environment: Regulators ensure Exness adheres to strict policies.

For traders, these measures ensure safety, reduce risks of fraud, and guarantee a trustworthy platform. A regulated broker like Exness gives traders the confidence to focus on their strategies without worrying about operational risks. operating under high standards, making it a reliable choice for traders globally.

Exness Licenses and Compliance

Exness is a globally recognized broker, holding multiple licenses from reputable financial authorities. These include the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK, the Financial Services Authority (FSA) in Seychelles, and the Financial Sector Conduct Authority (FSCA) in South Africa. These licenses ensure that Exness operates under strict regulatory standards, providing a secure trading environment for its clients.

To maintain compliance, Exness implements several key measures:

- Anti-Money Laundering (AML) Policies: Exness adheres to international AML standards, conducting regular internal and external audits to assess and enhance its AML practices.

- Client Fund Segregation: Client funds are kept separate from the company’s operational funds, ensuring protection against potential misuse.

- Data Security: Exness complies with the Payment Card Industry Data Security Standard (PCI DSS), conducting regular vulnerability scans and penetration tests to safeguard client information.

These measures demonstrate Exness’s commitment to upholding regulatory standards and providing a secure trading environment for its clients.

How Exness Protects Client Funds

Exness does everything to protect the assets of its customers. The company follows strict rules to provide security and full financial transparency. It includes the separation of customer assets from the company’s assets and protection against negative balance. This provides traders with confidence that their money is safe and well looked after.

Segregated Accounts

Exness keeps the clients’ funds in segregated accounts, distinct from the firm’s working funds. What this means is that traders’ money is never utilized for business purposes or any other purpose. These accounts are kept in very trustworthy and top-tier banks to make sure that the clients’ funds will be safe come what may.

Negative Balance Protection

Exness offers protection against negative balance, meaning that one cannot lose more than he or she has in the account. These cases mainly occur during high market volatility. This feature works in a way that if the balance goes negative, Exness returns it to zero and saves clients from further financial vulnerability.

Benefits of Trading with a Regulated Broker Like Exness

Trading with a regulated broker, such as Exness, guarantees transparency, confidence, and security for the client. The regulated broker follows strict standards imposed by the financial authorities for the protection of funds and the observation of fair trading practices. It also involves transparent reporting, the security of the transaction, and protection against market volatility.

Exness operates in full view, following the regulations set forth by international regulators, which entails publishing financial reports, segregating client accounts, and abiding by strict anti-money laundering rules. The clients can trade with complete confidence in full security of their funds, knowing the transactions will be dealt with intact.

Transparency creates trust between Exness and its clients. It is considered one of the most trustworthy brokers since it has continuously satisfied all the requirements by financial regulatory authorities. Its policy of open communication of fees, execution policies, and financial results instills more confidence among clients.

Support Access in Disputes with Exness

As a regulated broker, Exness provides clients access to dispute resolution mechanisms through its regulators. This ensures any issues are addressed fairly and professionally, protecting traders from malpractice. Clients can escalate concerns to regulatory bodies if needed, guaranteeing impartial resolutions.

Exness also offers 24/7 customer support to assist with disputes or concerns. With a multilingual team and clear processes in place, traders receive timely assistance, fostering a secure trading environment where disputes are handled efficiently and transparently.

Potential Risks of Unregulated Brokers

Trading with unregulated brokers carries significant risks. These brokers operate without oversight, making them less likely to follow fair trading practices or protect client funds. Without regulation, there is no guarantee of fund security, and traders may face issues like hidden fees, poor trade execution, or even fraud. Recovering lost funds or resolving disputes is often impossible with unregulated entities.

Unregulated brokers also lack accountability. They may offer attractive terms but fail to deliver on promises, leaving traders vulnerable. Choosing a regulated broker ensures adherence to financial laws, transparency, and client protection, reducing the likelihood of financial loss or unethical behavior.

How to Verify Exness Regulatory Status

To verify Exness’s regulatory status, follow these steps:

By confirming the broker’s regulation, you ensure your funds are protected and trading is secure. Practice this regularly to avoid falling into unregulated traps and to trade with confidence.

FAQs

Is Exness regulated in my country?

Exness operates under multiple licenses, so check the website to confirm availability in your region.

How can I verify Exness is a legitimate broker?

Check Exness’s regulatory status on the official websites of CySEC, FSCA, and other authorities.

What protection do I get as an Exness client?

Clients are protected through segregated accounts, negative balance protection, and regulatory oversight.

Can I trust Exness with my funds?

Yes, Exness is fully regulated by reputable authorities, ensuring client funds’ safety.

Does regulation affect trading conditions?

Regulated brokers must adhere to fair trading practices, ensuring transparent and reliable conditions.