Exness Leverage

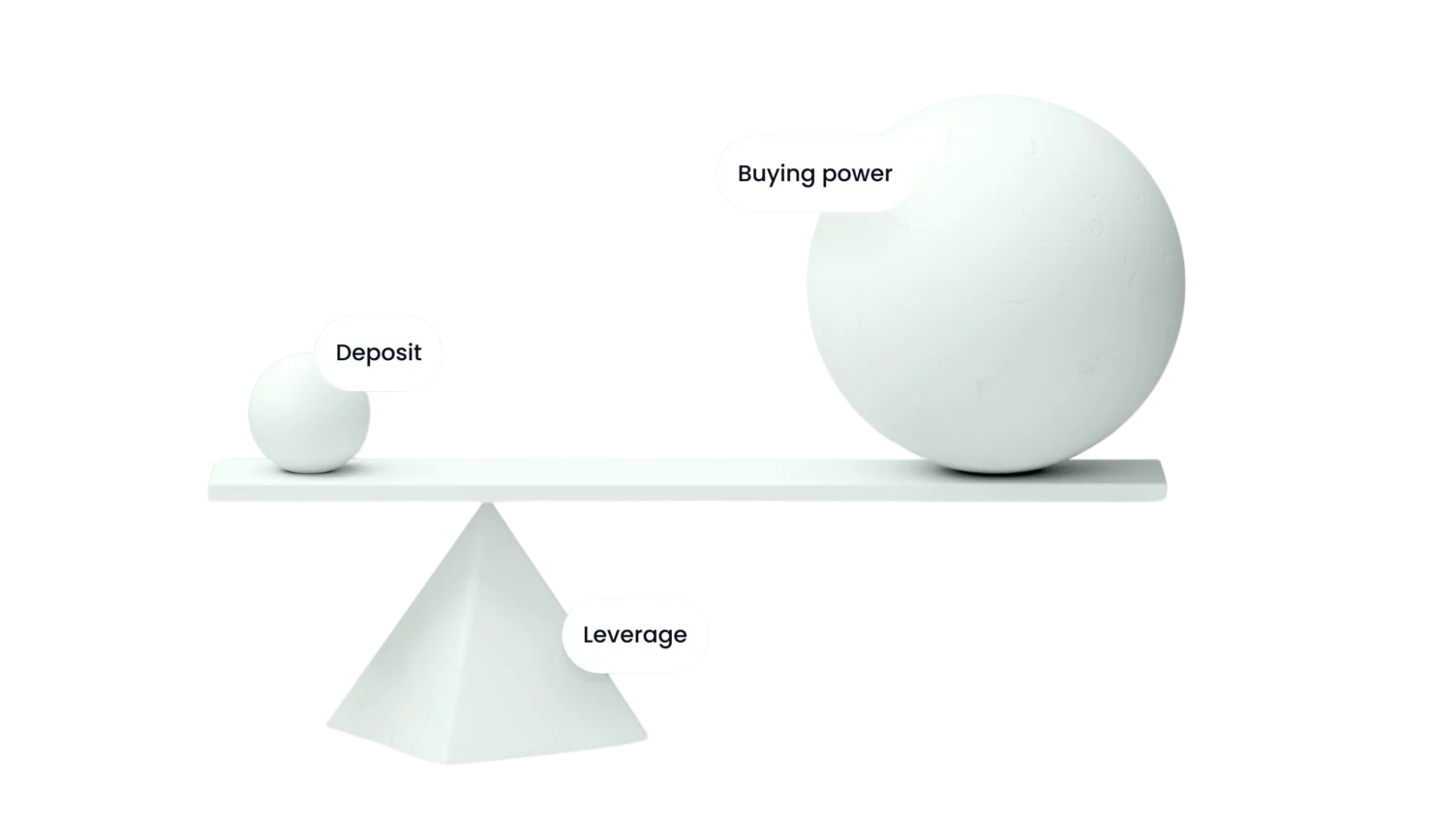

Exness provides variable leverage that allows traders to hold bigger positions with a relatively small investment. It is important to note that leverage amplifies potential profits and risks simultaneously. Traders are allowed to use leverage within their account type and trading experience on Exness, with some accounts allowing unlimited maximum leverage. This flexibility makes it easier to optimize strategies and manage market exposure.

What is Leverage and How It Works on Exness

Leverage is a tool that enables traders to borrow funds from the broker in order to increase their market exposure without requiring the full amount upfront. For example, if you have 1:100 leverage, you can control a $10,000 trade with only $100 of your own capital. With Exness, users can adjust leverage depending on their preference to make sure that they can tailor risk and reward.

Leverage depends on the Exness account type and trading tool. For example, accounts such as Standard and Raw Spread have variable leverage, while instruments like cryptocurrencies will have fixed but lower leverage because of their high volatility. Keep in mind that using higher leverage is associated with much greater potential return, but also comes with the risks of much larger losses. Always apply it with an evident risk management plan.

Available Leverage Levels on Different Types of Exness Accounts

Exness offers varied leverage, from unlimited to limited, depending on the account types and traders’ preferences based on their experience and goals. Standard accounts allow traders to use flexible leverage, also offering unlimited leverage for novice and professional traders. Professional accounts, like Raw Spread and Zero, are designed for advanced traders who require specific leverage settings depending on the instrument and market conditions.

Exness Content Overview

- What is Leverage and How It Works on Exness

- Maximum Exness Leverage

- Benefits and Risks of Using High Exness Leverage

- Strategies for Effective Risk Management When Using Exness Leverage

- Exness Margin Call

- Exness Stop Levels

- Choosing the Best Leverage for Trading on Exness

- How to Change the Exness Leverage?

- FAQ

Leverage on Standard Accounts

Standard accounts provide adjustable leverage, offering flexibility for traders to manage risk and amplify returns. Key leverage options include:

- Unlimited leverage for forex pairs (available under specific conditions).

- Fixed leverage for assets like cryptocurrencies and stocks.

- Customizable leverage based on trading preferences.

This leverage level is ideal for beginners testing strategies with minimal risk and for those who trade various instruments needing flexibility. Unlimited leverage can be especially useful for small account holders.

Leverage on Professional Accounts

Professional accounts, including Raw Spread, Zero, and Pro, offer leverage levels tailored to advanced trading needs. Features include:

- Unlimited leverage for forex pairs under specific conditions.

- Fixed leverage for indices and commodities based on instrument volatility.

- Lower leverage for high-risk assets like cryptocurrencies.

Professional accounts suit experienced traders aiming for precise market execution. Understanding the fixed leverage for volatile instruments ensures proper risk management while maximizing trade potential.count holders.

Maximum Exness Leverage

Exness offers up to unlimited leverage for certain instruments like forex pairs, depending on the trader’s experience, account type, and equity levels. Unlimited leverage allows traders to open larger positions with minimal capital. However, specific conditions such as maintaining low equity and trading particular instruments are required to qualify. This feature is especially beneficial for short-term strategies but demands careful monitoring to avoid overexposure.

Benefits and Risks of Using High Exness Leverage

High leverage allows traders to increase potential returns with a smaller initial investment. It can amplify gains on successful trades, making it attractive for both beginners and professionals. However, it also increases the exposure to losses, requiring disciplined risk management and a clear understanding of market dynamics. Properly applied, high leverage can enhance opportunities while keeping risks controlled.

Advantages of High Leverage

- Lower Capital Requirements: Trade larger volumes with smaller deposits.

- Enhanced Profit Potential: Amplifies returns on successful trades.

- Flexibility in Strategy: Enables scalping and other short-term methods effectively.

- Access to Multiple Markets: Allocate funds across various assets while maintaining position sizes.

High leverage benefits those trading with limited funds, particularly in low-volatility markets like forex. It’s best suited for traders with a strong grasp of risk management tools.

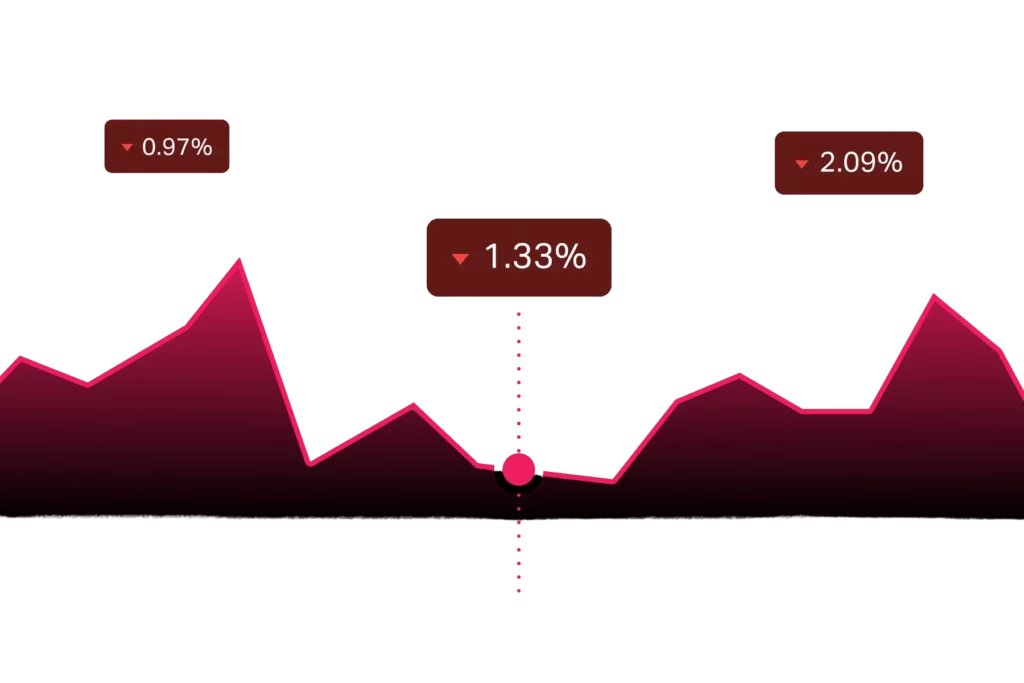

Risks of High Leverage

High leverage significantly magnifies losses. Even a small unfavorable market move can lead to substantial drawdowns or margin calls. Without proper risk control, overleveraged positions can quickly deplete account balances.

Traders should always set stop-loss orders and monitor market conditions to avoid unexpected outcomes. Over-reliance on leverage without understanding the market can lead to overtrading, emotional decisions, and account liquidation. A balance between leverage and equity ensures safer trading.

Strategies for Effective Risk Management When Using Exness Leverage

To use leverage wisely, traders should adopt risk management strategies like limiting position sizes, using stop-loss orders, and diversifying trades. Keeping leverage levels appropriate for the market conditions and capital size is crucial for long-term sustainability.

Key Strategies:

- Set Stop-Loss Levels: Protect your capital by limiting losses on each trade.

- Maintain a Healthy Margin Level: Avoid overleveraging and monitor margin requirements.

- Diversify Investments: Exness Spread risk across multiple assets to reduce exposure.

- Stick to a Trading Plan: Avoid impulsive decisions by following a structured approach.

For example, use a risk-reward ratio of 1:2 or better. This ensures that even if you lose half your trades, profits can still outweigh losses. Regularly review and adjust leverage to match your experience and account size.

Exness Margin Call

TA margin call occurs when your equity falls below a required percentage of the used margin, signaling the need to either add funds or close positions. On Exness, margin calls are automated and serve as a warning to maintain account stability.

Key Points:

- Margin Level Threshold: Margin call typically occurs when equity is 60% or lower of the used margin.

- How to Avoid It: Monitor trades regularly, use stop-loss orders, and ensure a balanced account.

- Immediate Action Required: Reduce exposure by closing high-risk positions or depositing additional funds.

To avoid frequent margin calls, maintain equity well above the minimum requirement. For example, if trading with high leverage, ensure adequate funds to support potential losses without triggering a call.

Exness Stop Levels

Stop levels define the minimum distance in points required between the current market price and pending orders, like stop-loss and take-profit levels. These ensure trades are executed within safe limits and maintain market fairness.

Stop levels vary by instrument. For example, major forex pairs like EUR/USD often have smaller stop levels than exotic currencies. Traders should always check these levels before placing orders to ensure proper execution.

Stop levels act as a safeguard against high volatility and slippage. When trading with Exness, ensure you understand the stop levels for each asset to plan entry and exit points effectively. Proper use of these levels helps in managing risk and maximizing returns.

Choosing the Best Leverage for Trading on Exness

The selection of the right leverage on Exness depends on one’s trading style, experience, and risk tolerance. While active day traders may prefer high leverage, lower leverage works best for long-term positions. Balance the leverage well with a solid risk management plan so that your capital is protected against the winds in the market.

Factors to Consider When Selecting Leverage

When choosing leverage, consider the following factors:

Beginners should start with lower leverage to minimize risk.

Larger balances can handle higher leverage, but overleveraging is risky.

Day traders may need higher leverage; swing traders often use lower leverage.

Volatile markets like cryptocurrencies require cautious leverage levels.

Match leverage to the amount you’re willing to risk per trade.

If trading forex with an account balance of $1,000, using 1:100 leverage is safer for new traders compared to 1:200 or higher. This allows manageable position sizes and reduces exposure to market swings.

Recommended Leverage for Beginners

For beginners, leverage between 1:10 and 1:50 is often ideal. It allows traders to participate in the market while minimizing the risk of significant losses. Starting with an Exness demo account can help new traders understand how leverage impacts their trades without risking real money.

For example, with 1:50 leverage, a $1,000 deposit enables trading positions up to $50,000. This balance keeps trades manageable and offers flexibility for beginners to learn market movements. Avoid high leverage early on, as it can lead to quick losses without proper market understanding.

By using lower leverage, beginners can develop confidence and a trading strategy before gradually increasing their exposure as they gain experience. Always pair leverage with stop-loss orders and a clear trading plan to manage risks effectively.

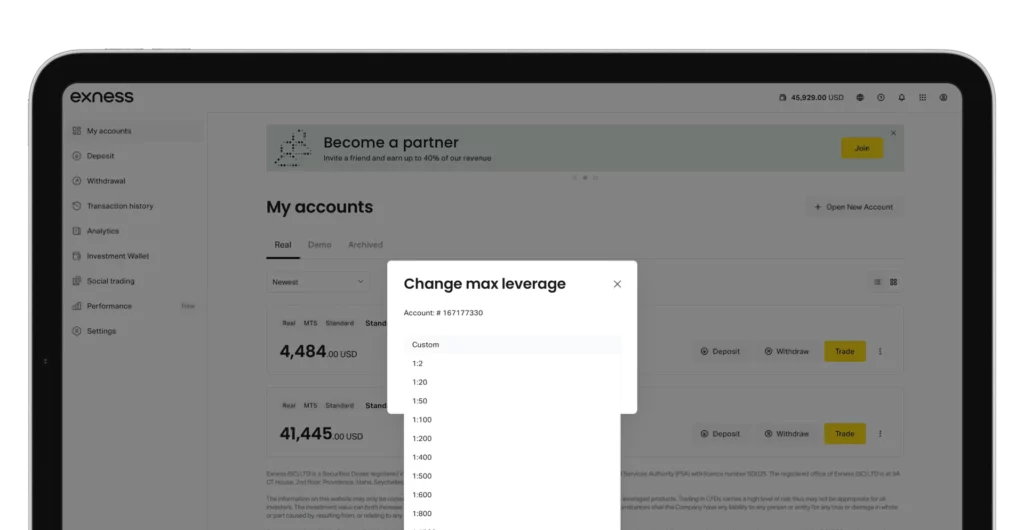

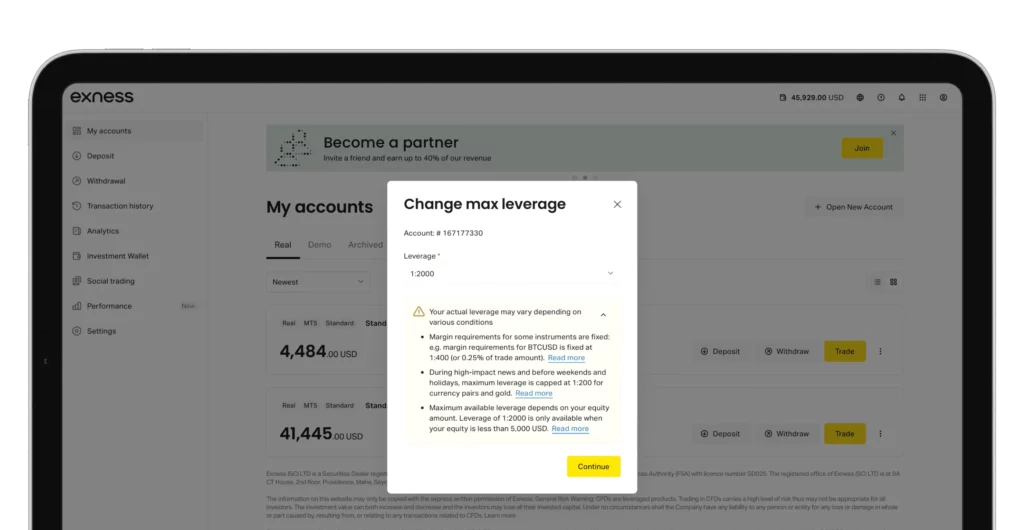

How to Change the Exness Leverage?

Changing leverage on Exness is a straightforward process that allows traders to adjust their risk levels based on their trading needs. You can modify your leverage through your Exness account settings. Always ensure the chosen leverage aligns with your trading goals and risk tolerance. Adjustments can be made for both new and existing accounts, depending on your trading strategy.

Steps to Adjust Leverage on Exness

To change your leverage on Exness, follow these steps:

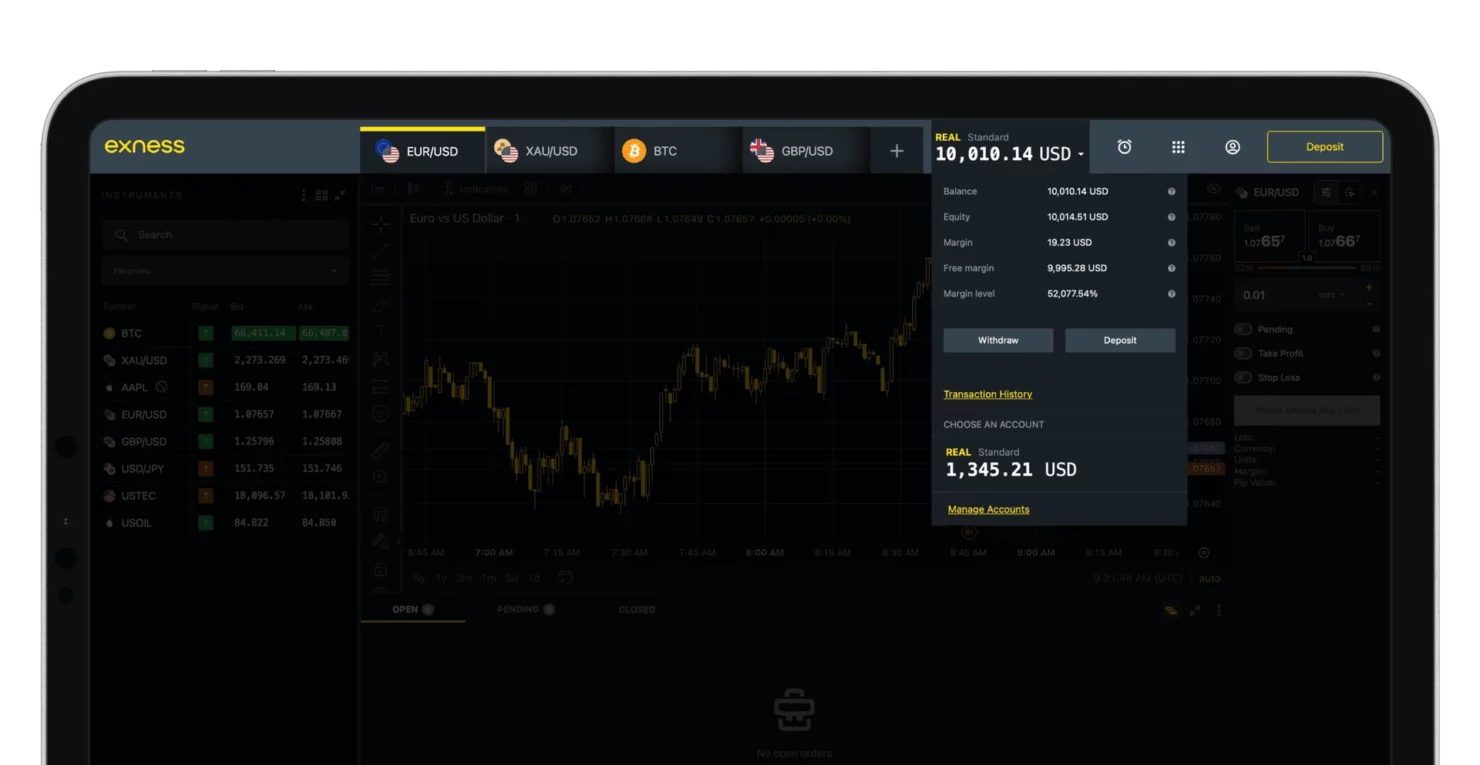

- Log in to your Exness account via the web or mobile app.

- Navigate to the ‘Accounts’ section.

- Select the trading account where you want to change leverage.

- Click on ‘Settings’ and locate the leverage option.

- Choose your desired leverage level from the available options.

- Save changes to apply the new leverage setting.

Suppose you’re trading with a 1:200 leverage and want to lower your risk. By logging in and reducing it to 1:100, your exposure decreases, allowing better control over market fluctuations. Changes in leverage may affect margin requirements. Ensure you review the margin impact before adjusting to avoid unintentional stop-outs during active trades.

Always review your risk management plan before making changes and apply leverage levels that suit your trading style and experience.

FAQ

What is the best leverage for $10?

The best leverage for a $10 account depends on your trading strategy and risk tolerance. For beginners, lower leverage like 1:50 or 1:100 is recommended to minimize risk. Higher leverage, such as 1:500, may allow larger trade sizes but also increases the risk of losing your capital quickly. Always trade cautiously with small accounts.

What is 1:400 leverage?

1:400 leverage means you can control a trade size 400 times the amount of your trading capital. For example, with $100, you can open positions worth up to $40,000. While this increases potential profits, it also amplifies risks, so careful risk management is crucial.

Is 1/500 leverage good for a beginner?

1:500 leverage is not recommended for beginners due to its high risk. While it allows traders to control larger positions with less capital, it can quickly lead to losses if the market moves against you. Beginners should start with lower leverage like 1:50 or 1:100 to learn proper risk management.

What is 1 to 100 leverage?

1:100 leverage means you can trade positions 100 times the size of your account balance. For instance, with $100 in your account, you can open trades worth up to $10,000. This leverage level offers a balanced approach to risk and trading flexibility, making it suitable for many traders.

How does leverage impact margin requirements?

Leverage directly affects the margin required to open a trade. Higher leverage reduces the margin needed, allowing traders to control larger positions with less capital. For example, at 1:100 leverage, only 1% of the trade size is required as margin, while at 1:50 leverage, 2% is needed. However, higher leverage increases risk, so proper risk management is crucial.

Can leverage be adjusted on Exness demo accounts?

Yes, leverage can be adjusted on Exness demo accounts. You can set the leverage when creating the Exness account or modify it later in the account settings. This flexibility allows traders to test various leverage levels and their impact on trading strategies in a risk-free environment.