Exness Account Types

Exness has different types of accounts that cater to various traders’ needs-from the complete beginner to the seasoned professional. Each account has its special features: competitive spreads, flexible leverage, and a wide range of trading instruments. Whether you are a beginner or want advanced trading conditions, with Exness you’re definitely covered.

Types of Accounts Offered by Exness

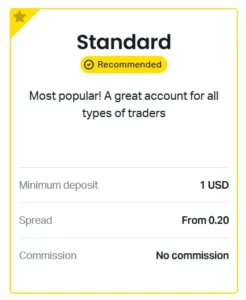

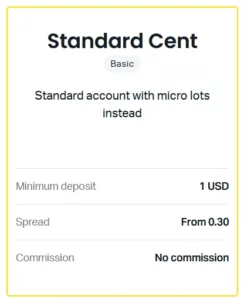

Exness offers two key categories: Standard and Professional. The Standard account is ideal for beginners, with low minimum deposits and user-friendly options. Under this category are the following accounts: The Standard and Standard Cent accounts, offering flexible trading without any commission, but with wider spreads. These features make them accessible to newcomers or those testing strategies with a minimal investment.

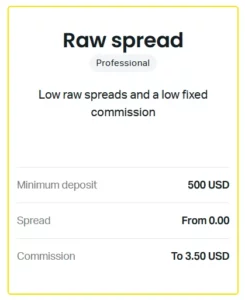

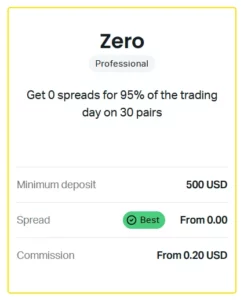

Professional accounts are designed for advanced traders looking for professional tools and economic trading. Options such as Raw Spread, Zero, and Pro accounts offer tighter spreads, faster execution, and additional features. The Raw Spread and Zero accounts are quite popular among high-frequency traders since they have very low spreads with fixed commissions. The Pro account offers no commission with tight spreads to balance cost and flexibility for the advanced trader.

Exness Content Overview

- Types of Accounts Offered by Exness

- Standard Exness Accounts

- Professional Exness Accounts

- Exness Islamic Account

- How to Create an Exness Account

- Countries Where Exness Is Not Available

- Comparing Exness Account Types

- Exness Account Fees and Charges

- Advantages and Disadvantages of Exness Accounts

- FAQs About Exness Account Types

Standard Exness Accounts

Standard Exness accounts are designed for traders seeking simplicity and accessible features. These accounts require low initial deposits, have no commission fees, and offer flexible trading options, making them perfect for beginners or casual traders who want to start trading without significant financial commitment.

Standard Account

The Exness Standard Account is ideal for new traders due to its low deposit requirements and access to numerous trading instruments. With no commission fees, it provides an affordable option for cost-conscious traders. The account also features a user-friendly interface and competitive spreads on major currency pairs, making it suitable for both beginners and experienced traders.

Standard Cent Account

The Cent Standard Account is for those who are at the beginning stage or testing strategies on smaller funds. Trading in cents, instead of dollars, this account type minimizes risks, with no commissions and variable spreads. Its low entry requirements make it a perfect option for new traders who gain experience in real market conditions.

| Feature | Exness Standard Account |

| Minimum deposit | Low, starting from $1 |

| Spreads | Variable, starting from 0.3 pips |

| Commission | None |

| Available Assets | Forex, metals, cryptocurrencies, indices, energies |

| Leverage | Up to 1:2000 |

| Order execution | Market execution |

| Platform Availability | MT4, MT5 |

| Margin call level | 60% |

| Stop out level | 0% |

| Trading Hours | 24/5 (forex market hours) |

| Expert Advisors | Supported |

The Standard Account is a great option for traders looking for the most straightforward and cost-effective way to access forex and other markets. With no commission fees and flexible leverage, it allows traders to learn and develop their strategies comfortably.

| Feature | Exness Standard Cent Account |

| Minimum deposit | Very low, starting from $1 |

| Spreads | Variable, starting from 0.3 pips |

| Commission | None |

| Available Assets | Forex, metals |

| Leverage | Up to 1:2000 |

| Order execution | Market execution |

| Platform Availability | MT4 only |

| Margin call level | 60% |

| Stop out level | 0% |

| Trading Units | Cent units (balance displayed in cents, e.g., $1 = 100 cents) |

| Trading Hours | 24/5 (forex market hours) |

| Expert Advisors | Supported |

The Cent Standard account is perfect for beginners and those who want to try strategies with minimal investments. Trading in cents enables users to get familiar with the platform, learn how trading works, and minimize losses. This is an excellent educational tool for new traders.

Professional Exness Accounts

It offers three main professional account types, namely Raw Spread, Zero, and Pro. They include tighter spreads, faster execution of orders, and give them better cost control. The account minimum deposits are somewhat higher, but in general, they have advanced features with competitive trading conditions. These are indeed good for professional needs.

Raw Spread Account

The Raw Spread account is perfect for those traders who would not want to see their profits eaten away by trading costs. Spreads start from 0.0 pips, making it a real Vollgeldberater for scalpers and high-frequency traders alike. While there is a small commission, the tighter spreads greatly reduce overall trading costs.

Zero Account

The Zero Account provides spreads as low as 0.0 pips on major pairs, with a commission charged per trade. It would be a perfect solution for those traders needing quotes with high accuracy and fixed commissions instead of variable spreads. Commissions vary by asset, allowing a clear breakdown of trading costs for better transparency in this regard.

| Feature | Exness Raw Spread Account |

| Minimum deposit | $200 |

| Spreads | From 0.0 pips |

| Commission | $3.5 per lot (each side) |

| Available Assets | Forex, metals, cryptocurrencies, indices, energies |

| Leverage | Up to 1:2000 |

| Order execution | Market execution |

| Platform Availability | MT4, MT5 |

| Margin call level | 60% |

| Stop out level | 0% |

| Trading Hours | 24/5 (forex market hours) |

| Expert Advisors | Supported |

The Raw Spread Account is ideal for those traders who want to save trading costs .

| Feature | Exness Zero Account |

| Minimum deposit | $200 |

| Spreads | 0.0 pips on major pairs |

| Commission | From $3.5 per lot (varies by asset) |

| Available Assets | Forex, metals, cryptocurrencies, indices, energies |

| Leverage | Up to 1:2000 |

| Order execution | Market execution |

| Platform Availability | MT4, MT5 |

| Margin call level | 60% |

| Stop out level | 0% |

| Trading Hours | 24/5 (forex market hours) |

| Expert Advisors | Supported |

The Zero Account will suit the needs of those traders who require accurate pricing and prefer to have fixed commissions per trade. The 0.0 pip spread on major pairs is quite transparent and thus finds its popularity among professionals who are trading in high volume.

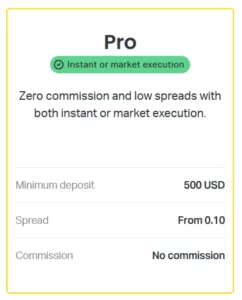

Pro Account

The Pro Account represents a versatile option for traders in search of professional conditions with no commission. It offers variable spreads starting at 0.1 pips and faster order execution, making this account type versatile to fit multiple trading styles. Because there is no commission in addition to already competitive spreads, it becomes very popular among experienced traders who need both flexibility and reasonable costs.

| Feature | Exness Pro Account |

| Minimum deposit | $200 |

| Spreads | From 0.1 pips |

| Commission | None |

| Available Assets | Forex, metals, cryptocurrencies, indices, energies |

| Leverage | Up to 1:2000 |

| Order execution | Market execution |

| Platform Availability | MT4, MT5 |

| Margin call level | 60% |

| Stop out level | 0% |

| Trading Hours | 24/5 (forex market hours) |

| Expert Advisors | Supported |

The Pro Account is the best solution for those traders who need tight spreads with no commission. It offers professional trading conditions starting from a low starting spread, which caters to most strategies widely, giving room for flexibility at cost-effective trading conditions.

Exness Social Trading Account

The Exness Social Trading Account allows users to copy strategies executed by experienced traders. You can view profiles of top traders, look at their past performance, and automate trade copying. This account is ideal for beginners or people with limited time since one can trade without needing to create your own strategies, thus making trading easier and simpler.

Exness Demo Account

Exness Demo Account is a no-risk ground where one may train and perfect their skills. It allows traders to learn the platform with an opportunity to test strategies and understand market movements without any financial commitment. It is highly suitable for learning among beginners and trying out new techniques among experienced traders before going live.

| Features | Exness Social Trading Account |

| Minimum deposit | Varies based on chosen trader’s requirements |

| Spreads | Determined by the selected trader’s account type |

| Commissions | Profit-sharing fee based on trader’s performance |

| Available Assets | Varies by trader, typically includes forex, metals, indices, and more |

| Platform Availability | Exness Social Trading app |

| Key Benefits | Easy access to copy trades from professional traders |

| Control Options | Adjustable copy settings, stop-loss limits, and investment amounts |

An Exness Social Trading Account is used for clients who would like to benefit from professional analysis with the least effort about trade management. Limits can be set, and one can monitor performance to learn from other successful traders in the simplest way possible.

| Features | Exness Demo Accounts |

| Minimum deposit | None, as it uses virtual funds |

| Spreads | Same as live account conditions (varies by account type) |

| Commissions | None, as no real money is involved |

| Available Assets | Forex, metals, cryptocurrencies, indices, energies |

| Platform Availability | MT4, MT5, and Exness Web Terminal |

| Key Benefits | Practice trading with zero financial risk |

| Control Options | Allows for adjusting virtual funds to test different trading conditions |

The Exness Demo Account is a great tool for learning about trading without losing money. It’s a learning tool that allows real-time traders to practice and understand exactly how to build confidence and test strategies prior to heading into a live account.

Exness Islamic Account

| Features | Exness Islamic Accounts |

| Minimum deposit | Varies by account type; starts from $1 for Standard accounts |

| Spreads | Tight and variable spreads available |

| Commissions | No commission on Standard accounts; fixed for others |

| Available Assets | Forex, metals, cryptocurrencies, indices, energies |

| Platform Availability | MT4, MT5, and Exness Web Terminal |

| Key Benefits | Practice trading with zero financial risk |

| Eligibility | Traders must activate swap-free settings in their Personal Area |

| Swap-Free | No overnight interest fees (complies with Shariah law |

| Leverage | Up to 1:2000 depending on the account |

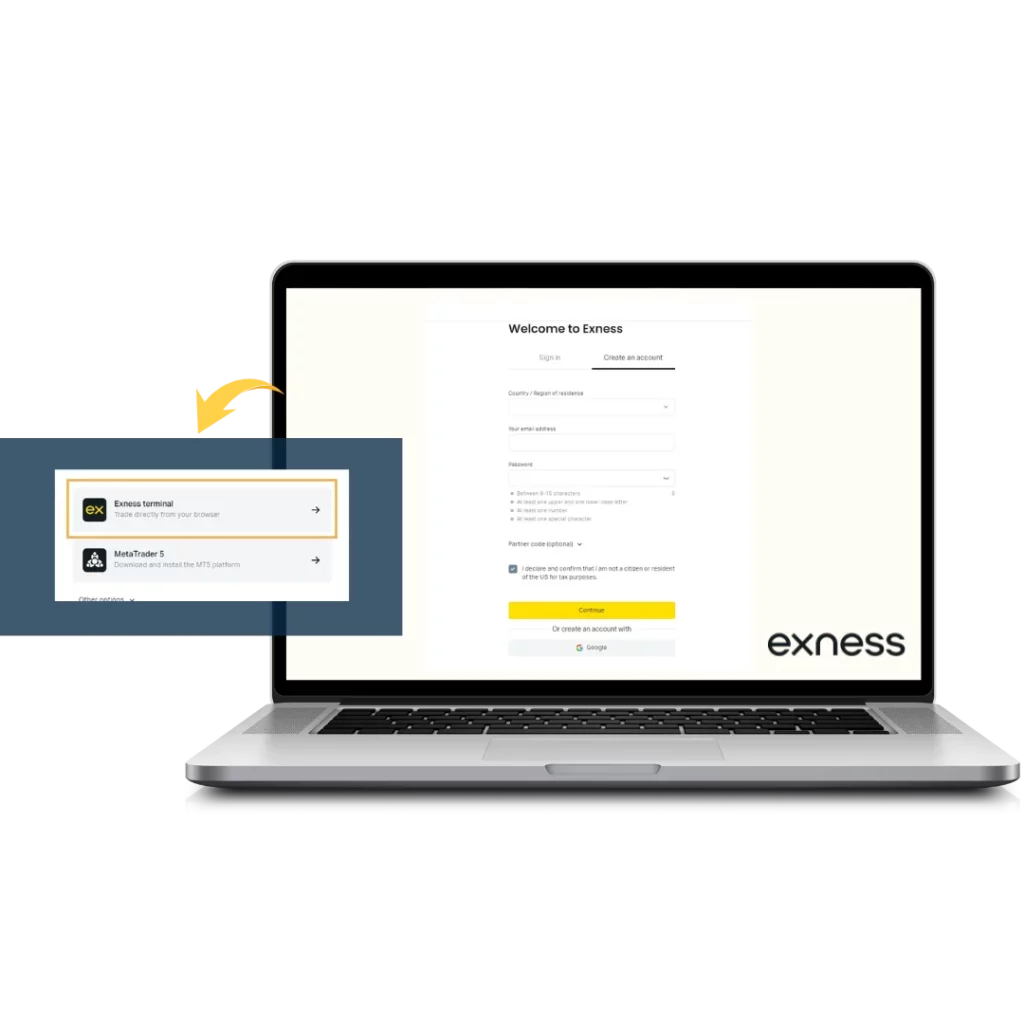

How to Create an Exness Account

Creating an Exness account is simple and takes just a few minutes. Follow these steps to get started:

- Visit the Exness Website: Go to the official Exness website.

- Click on “Register”: Find the registration button on the homepage.

- Enter Your Details: Provide your email, create a password, and select your country of residence.

- Confirm Your Email: Check your email for a confirmation link and click it.

- Set Up Your Personal Area: Log in to your new Exness account and complete your profile by entering personal details.

- Verify Your Identity: Upload the necessary documents to verify your identity and address.

- Choose Your Account Type: Select from Standard or Professional account options based on your trading needs.

- Start Trading: Deposit funds, set up your trading platform, and begin trading.

By following these steps, you’ll be ready to trade on Exness and enjoy its wide range of features.

Countries Where Exness Is Not Available

Exness operates globally but is restricted in specific countries due to local regulations and compliance issues. These include regions like the United States, Canada, North Korea, Iran, Israel, Belgium, and certain jurisdictions in Australia and New Zealand. Traders in these regions cannot access Exness services due to strict financial oversight or geopolitical restrictions.

These restrictions are imposed to ensure compliance with local laws and regulatory requirements. If you’re in one of these countries, you might need to explore brokers that adhere to your region’s financial regulations. Always verify the latest availability on the Exness official website to stay informed.

Comparing Exness Account Types

Exness offers two main account categories: Standard and Professional. Standard accounts, including Standard and Standard Cent, are user-friendly, require low deposits, and have no commissions, making them ideal for new or casual traders. Professional accounts like Raw Spread, Zero, and Pro offer tighter spreads, advanced features, and competitive costs, tailored for experienced traders who require greater control and efficiency in their trades.

Which Account is Best for Beginners?

For beginners, the Standard Account is the best choice. It requires a low minimum deposit, has no commission fees, and provides flexible trading options. The Standard Cent Account is another excellent option for those looking to trade smaller amounts and test strategies with minimal risk, as it uses cents instead of dollars for trading.

Which Account is Best for Professionals?

Experienced traders will find the Professional Accounts more suitable. The Raw Spread Account offers tight spreads starting at 0.0 pips, combined with fixed commissions, making it ideal for scalping and frequent trading. The Pro Account, with no commission fees and competitive Exness spreads, provides a balance of cost and flexibility, appealing to professionals who want a straightforward trading experience.

Exness Account Fees and Charges

Exness accounts come with different fee structures depending on the type of account you choose. Standard Accounts have no commission fees, making them cost-effective for new and casual traders. However, spreads are slightly wider compared to professional accounts. Professional Accounts (Raw Spread, Zero, and Pro) offer tighter spreads but may include fixed commission fees for specific account types, such as Raw Spread and Zero.

Additionally, Exness does not charge deposit or withdrawal fees for most payment methods, though third-party charges may apply depending on the provider. Overnight swaps (interest charged on open positions) vary by instrument, and swap-free options are available for Islamic accounts.

Advantages and Disadvantages of Exness Accounts

Advantages:

- Low Minimum Deposits: Start trading with minimal initial funds.

- No Commission on Standard Accounts: Reduces trading costs for new traders.

- Tight Spreads on Professional Accounts: Ideal for scalpers and high-frequency traders.

- Variety of Accounts: Options for both beginners and experienced traders.

- Swap-Free Islamic Accounts: Sharia-compliant trading available.

- Flexible Exness Leverage Options: Traders can adjust leverage to suit their strategies.

Disadvantages:

- Fixed Commissions on Some Accounts: Professional accounts may include fixed charges per trade.

- Wider Spreads on Standard Accounts: Higher trading costs compared to professional accounts.

- Not Available in All Countries: Restricted in regions like the US and Japan.

- Complex Account Options: New traders might find it challenging to choose the right account.

FAQs About Exness Account Types

What are the different Exness account types?

Exness offers two main categories: Standard Accounts (Standard, Standard Cent) and Professional Accounts (Raw Spread, Zero, Pro). Standard Accounts are beginner-friendly with no commissions and low deposits, while Professional Accounts provide tighter spreads and advanced features for experienced traders.

Which account is best for new traders?

The Standard Cent Account is ideal for beginners. It allows trading in smaller amounts (cents) with no commission, making it low-risk for learning.

Which account is best for professionals?

The Raw Spread Account offers low spreads starting at 0.0 pips and fixed commissions, making it suitable for scalpers and experienced traders.

Are there any swap-free accounts?

Yes, Exness offers Islamic accounts that are swap-free, suitable for traders adhering to Sharia principles.

What is the minimum deposit for Exness accounts?

For Standard Accounts, there’s no fixed minimum deposit. For Professional Accounts, the minimum deposit starts from $200.

Are Exness accounts suitable for scalping?

Yes, Professional Accounts like Raw Spread and Zero are ideal for scalping due to low trading costs and tight spreads.

Can I have multiple Exness accounts?

Yes, traders can open multiple Exness accounts to test strategies or manage different trading goals.

How do I choose the right Exness account?

New traders can start with the Standard Cent Account for lower risk, while professionals might prefer Raw Spread or Zero for advanced trading features.